Phil Hearn: Blogger, Writer & Founder of MRDC Software Ltd.

Which keywords find the right survey software for you?

If you are looking for market research survey software, you might wonder how to start your search. I decided to explore the home pages of 61 survey software suppliers and check for the presence of 34 keywords. I wanted to know how my own company compares with other software suppliers, particularly as an increasing number of end-to-end platforms are available, offering different levels of sophistication – all with their strengths and weaknesses.

Where software stands in market research now

The market research industry is wholly dependent on software for its success, a distinct change from 25 years ago. Whether software vendors send out the right messages and whether research agencies choose the right software offer the opportunity for endless debates. I carried out this research, partly to focus my mind on 2022, partly to assess what messages software vendors are sending out, but also as a fun topic to start 2022. Perhaps, it’s also because I don’t believe research agencies always pick the most suitable software for their business or spend as wisely as possible, but that’s another story.

Research on software vendors’ homepages

My research is admittedly not the most scientific and not as deep as it might be. I have analysed the data on the homepage of 61 software vendors and checked for the incidence of 34 keywords. I conducted this research in November 2021. There is no research into the depth of information on websites, which varies from high quality to woefully incomplete and from sales drivel to informative content. In my view, a website should answer the questions why, how, what – and, in that order. Credits for that comment go to Simon Sinek from an inspirational TED talk over ten years ago. However, the homepage should make it clear what you do, preferably why you do it, and state or imply what you don’t do. So, what words do the industry’s software vendors use?

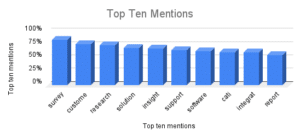

Surveys, research and insights

I was pleased to see that survey was the most common of the 34 words surveyed on homepages. 85% of software companies used the word, with research at 75% and insights at 69%. This seems logical to me as software users typically conduct surveys, the business is market research, and, sometimes, the software might help you find insights. I question whether 69% of software products produce insights; surely, they are just a conduit to giving the potential for insights in most cases. I guess I am declaring a personal bias here; I have never liked to describe our industry as the insights industry or the insights business. There are two reasons for this. Firstly, no research guarantees revealing insights, unless you believe that confirming what you thought is an insight. Secondly, and more importantly, insights or business insights is not Google-friendly. It covers too much and does not pull up research agencies on the first page of a Google search. I have just Googled insights industry and have found few research agencies in the first ten pages of my search. When I Googled insights business, I found Barclays Bank, Xero accountancy software, Forbes and others muscling out market research agencies from the first ten pages – and who looks beyond page two of a search anyway?

Surprises

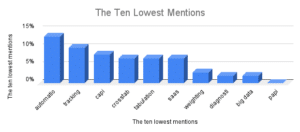

I was a little surprised to find customer in second place on 77%, while I found it hard not to dismiss solution as just a buzzword to sell on 70%. Support scored well with 66%. I’m pleased to see this as I often feel that software companies let themselves down by not providing the right level of support, either through humans or content, such as videos, on the website. CX, import and export surprised me a little – all three weighed in at around 20%. Of the low scorers, tracking at 10% was the standout figure for me. I see tracking studies as being a vital part of the industry and the type of research in which, I believe, MRDC excels. However, it confirms my opinion that few software products can handle the practical intricacies of tracking studies, where questions, code lists and data layouts change. Tracking studies are still the weak point of many software products. Finally, automation at 13% was lower than I expected. Again, this is an area that we have seen as crucial to market research over the last ten years; our software development has focused on automation in the previous 5-10 years.

Easy and intuitive

I suspect there were no claims that software products were difficult to use or counterintuitive and, sure enough, easy came in at 44% and intuitive lagging on 15%. I think too many software providers like to pretend that their software is easy and intuitive rather than taking the risk and spelling out how much effort you need to put in for proficiency and high efficiency. We like to be upfront about this. One of our products, the tabulation software MRDCL, requires high commitment to get the best results, whereas QPSMR is genuinely easy to use. I assume from this that companies with one solution feel the need to push their product as ‘easy’, whereas we offer multiple products to suit a range of potential users.

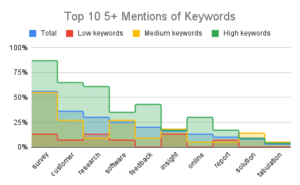

Multiple mentions

When tested for multiple use and high usage (6+ times), most keywords declined in percentage terms at a predictable rate. There were some exceptions, though. Survey ‘held up’ best with 85% (any mention), 77% (2+ mentions), 56% (high usage), whereas insights collapsed with 69%, 51% and 16% respectively. Feedback’s comparative figures were more like survey’s with 46%, 39% and 20%, while easy collapsed with 44%, 28% and 2%. I guess there’s no need to hammer home the point that a product is easy to use; software vendors simply feel the need to say it!

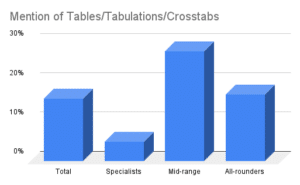

What about tabulations/crosstabs/tables?

As a leading supplier of tabulation software, I had some self-interest in seeing how tabulations/crosstabs/tables performed. Even when combined, these words only had an incidence of 16%. I came to two conclusions explaining this popular aspect of market research analysis. Firstly, having a crosstab component in software is taken for granted generally. Secondly, though, there are not many fully-featured crosstab products. Good enough crosstab software may be satisfactory much of the time, but only a few specialists can crunch any tabulatable data.

(This analyses presence of mentioning tables/tabulations/crosstabs by specialists (covering few groups of keywords) and all-rounders (covering wide range of keywords)

Data integration

I was disappointed about the lack of consideration for integration, import and export. The figures were 62%, 20% and 20%, respectively, but these fell away quickly when analysing multiple mentions. Integration dropped to 2% for high usage. The future of research, in my view, hinges on the ability to move, integrate and use market research data as efficiently as possible. I would like to see these figures higher.

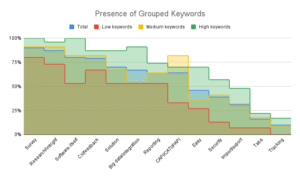

Grouped mentions

The 34 keywords were grouped into 13 categories. Unsurprisingly, this had the effect of putting categories such as surveys/survey instruments, research/insights, software, cx/feedback all bunched around the 80% to 90% mark. The data was more interesting when analysing multiple mentions of the 13 categories. Four levels were measured – single mentions, multiple (2+), high (6+) and very high (21+). The percentages for research/insights were 87%, 79%, 49%, 8% respectively, whereas survey/survey instruments were 90%, 80%, 62% and 30%. Reporting held up well at 64%, 44%, 23% before being 0% for 21+ mentions.

Mentions-based data

The mentions-based data produced somewhat different results, not unexpectedly. The 61 homepages had a total of 3178 of the 34 keywords. Those with a low number of keywords in total tended to focus on the basics – research, insights, solution whereas those with a high number focused on survey and feedback.

What does this all prove?

As I stated in my introduction, I undertook this task to see how MRDC Software compared and as a ‘fun’ exercise. I feel that software vendors are too keen to push solution and easy, whereas they should be following Simon Sinek’s advice and explaining why and how. It proved to me, to a greater extent, that MRDC Software tends to be different in five distinctive ways:

- We are experts at tabulations; others are mainly just adequate

- We put a premium on good human support with first-class materials, such as videos

- We seek to automate where it makes sense

- We offer a wide range of solutions to meet different needs

- We are honest about what is easy and what is not

Data was collected from 61 websites between 6th and 8th November 2021